Everyone has probably heard of a Net Promoter Score (NPS), the popular measure of customer loyalty. But many people who know it’s important still aren’t sure what it really means, how it is calculated, or what is considered a good or bad score.

What is Net Promoter Score?

Net Promoter Score is a way for companies to measure customer loyalty. The method for measuring a company’s NPS is actually pretty simple. In fact, only a single question is asked. On a scale of zero to ten, how likely are you to recommend product/service X to a friend? It seems really easy.

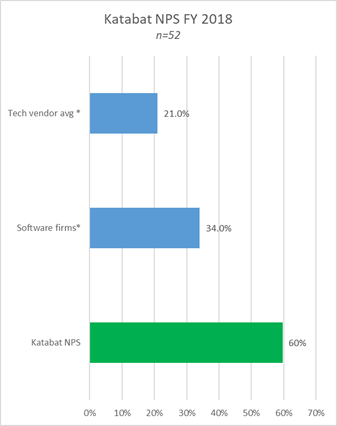

You may have noticed, however, that when companies report their NPS, they use numbers like 40 or -10. We’re very proud of our +60 score, and wanted to dive down into how the original ratings on a scale of zero to ten get calculated into an NPS. So, what does that rating really mean?

Sorting the ????, ☹️, & ????

First, a little background will be helpful. Once customers rate how likely they would be to recommend a product or service, they get divided into three groups:

- Detractors

- Passive

- Promoters

Detractors are those respondents who answered with an NPS rating anywhere from zero to six. They are the dissatisfied customers who are complaining on Facebook. Anyone giving an answer of seven or eight is in the passive category. These people aren’t unhappy, but they aren’t happy either. If they see a similar product with competitive offerings, they are likely to switch providers.

It is only those who rated their likelihood of recommendation as a nine or a ten who are considered promoters. This may seem like a skewed way of dividing people, but if you think about it the divisions make sense. If you asked a friend how they would rate a restaurant and they gave it a six, for example, chances are you are never going to try that restaurant. Even a seven or eight likely wouldn’t get you in the door. When we look to others for suggestions, we want their nines and tens.

Crunching the Numbers: Net Promoter Score Calculation

The next step is where the magic happens. The passive population gets ignored at this point. These people don’t have positive or negative feelings about the product. They are neutral, and hence don’t affect the score. What’s important is the percentage of respondents who are detractors and the percentage who are promoters. Take the percentage of promoters, subtract the percentage of detractors, and the result is that company’s NPS.

What is a Good Net Promoter Score?

What is considered a good score versus a bad score depends a lot on what kind of company you’re talking about. The average NPS for a grocery store is 36, while the average NPS for a cable provider is (unsurprisingly) three. Depending on the sector you’re considering, an NPS of 20 could be great, or it could be lousy. It’s important to compare apples to apples when looking at NPS.

How Are We Doing?

At Katabat, we look at scores of other tech vendors, software firms, and SaaS companies to determine how we measure up when it comes to customer loyalty. The average NPS of tech providers is 21. For software firms the average is higher at 34. B2B SaaS companies have the highest average NPS at 40. It’s nice to be operating in an industry where customers end up satisfied.

At Katabat, we look at scores of other tech vendors, software firms, and SaaS companies to determine how we measure up when it comes to customer loyalty. The average NPS of tech providers is 21. For software firms the average is higher at 34. B2B SaaS companies have the highest average NPS at 40. It’s nice to be operating in an industry where customers end up satisfied.

Our +60 NPS would be excellent in any sector. This score means that when asked how likely they would be to recommend Katabat to a friend, almost two thirds of our customers gave an answer of nine or ten. GrowthScore, a provider of NPS software, recently reported that only the best B2B SaaS providers have an NPS above 55.

At Katabat, we pride ourselves on how we treat and serve our customers. After all, as digital collections software provider our mission is focused on excellent customer experiences. We want our customers to be happy and loyal just as much as we want your customers to be happy and loyal. And while we are proud of our NPS, we are always striving to be even better.

Do you share our passion for converting neutral customers into enthusiastic promoters? Let’s talk about how great customer experiences can boost your revenue at info@katabat.com.

=

Katabat is the leading provider of debt collections software to banks, agencies, and alternative lenders. Founded in 2006 and led by a diverse team of lending executives and leading software engineers, Katabat pioneered digital collections and has led the industry ever since. It is our mission to provide the best credit collections software in the market and solve debt resolution from the perspectives of both lenders and borrowers.

More from Katabat