Companies spend a lot of time, effort, and marketing budget trying to get in the news. But there are some times you do not want your company in the news. As a founder and CTO, I never want to be in the news because of a failed product. Honestly, much of the time that I see “artificial intelligence” (AI) mentioned online, it is because of a project that did not turn out as intended.

Perhaps the AI is delivering underwhelming results (Echo Look)

Or perpetuating bias (voice assistants).

Maybe it turns out the AI isn’t even actually AI.

I don’t want to be those guys. So as I worked to use my AI research background to enhance our debt collection product offerings with cutting-edge machine learning, I knew we needed to have a good plan. In general at Katabat, we use agile processes to ensure that there are clearly defined objectives for projects. Big projects get broken up into manageable chunks and there is plenty of opportunity for customer feedback. This approach guided my outlook for our machine learning projects as well.

Machine Learning on a Budget

Artificial intelligence and machine learning projects have a reputation for being really expensive. In a lot of cases this is because they are trying to do a huge number of different things. Think about all the different kinds of decisions that go into driving a car, for instance. Tesla has to solve challenges in computer vision in very complicated environments, manage the engine and steering control, and optimize mapping and path planning.

Big and complex projects like developing autonomous cars are expensive and have a decent chance of failing. I am a lot more inspired by projects like AlphaGo and AlphaZero. These are the algorithms that studied the board games Go and chess and became stronger than human grandmasters. The projects were a success because they had a very clearly defined goal and a limited scope.

When it comes to machine learning, Katabat is very focused on one thing and one thing only. We want to be the best-of-breed machine learning solution to optimize digital communication strategies. The only goal is to generate higher response rates in the context of debt collection. Yes, our algorithms could also train on other datasets and solve other related problems. But rather than trying to do everything at once, we are keeping a laser-sharp focus on collections contact rates.

Human experience is a big part of machine learning. It’s humans who decide the problems that need to be solved, provide the datasets, and set up the training. Often, humans already have a certain degree of success with existing business solutions (without machine learning) based on years of experience, which should not be disregarded. Instead of relying entirely on machine learning, a successful project should also directly leverage the expertise of the humans involved. In this area, we are very fortunate at Katabat to have a vast trove of collections expertise in our team. We’ve distilled their knowledge in a digital strategy library, which the machine learning engine can then mine for the specific right approach for each individual customer. We maximize performance for our customers by combining humans’ and machines’ distinctive advantages.

The result of our focus?

We have quickly developed machine learning that works, without spending the GDP of a small country. We can give our clients a turn-key digital strategy solution powered by machine learning. Our clients benefit because they don’t need to build their own artificial intelligence research arm, again facing investing huge amounts of money and time in a job market where expertise is at a premium. It also helps them stay focused on their actual business.

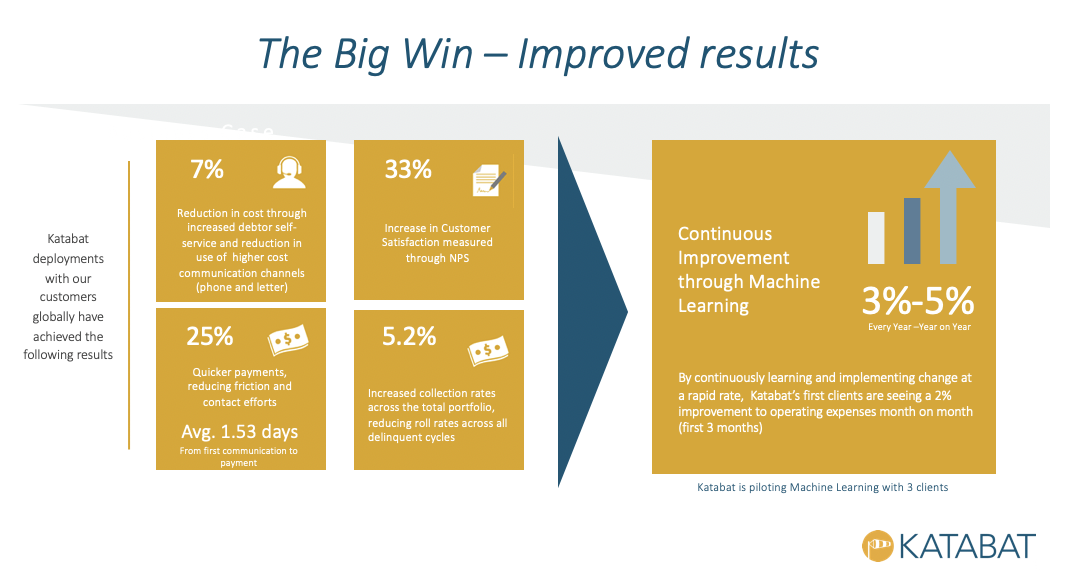

Improvements measured from actual Katabat clients through machine learning.

Financial institutions and debt collection agencies should seriously consider buy vs. build when they want to deploy the latest machine learning technology to solve certain needs. If all the business needs is a digital strategy to maximize response rates in collections, Katabat’s Engage avoids the hassle of building their own. This is the most efficient way to put machine learning in use immediately. The Engage product can also be bundled with any of our other products, allowing an organization to implement a full spectrum of digital debt management and customer relationship management tools seamlessly.

The Machine Learning Moment Is Now

My job is to create the best software products for debt collectors—technology that really solves their business challenges and helps them collect more money. I don’t spend a lot of my time on economic forecasting. However, some of my colleagues do pay a lot of attention to the market conditions that our customers are dealing with. It is hard to ignore the fact that the economy looks like it is due for a recession.

When a recession comes, it always means crazy times for lending institutions and debt collectors. The people who come out ahead are the ones who planned ahead. They think about what tools can help them deal with fewer people paying their bills and more people ending up in collections. They select technology that helps automate regulatory compliance in a changing climate.

Preparing ahead of time by implementing the latest machine learning solutions for tracking down customers and reaching them on their preferred channels is a great way to optimize your chances of getting paid. Ready to see what Katabat’s machine learning for debt collectors can do for your business? Reach out at info@katabat.com.

About Ye Zhang:

Ye is Katabat’s CTO and co-founded the company in 2006. He is an avid technologist and continues to enjoy creating technology solutions to solve business problems. Ye’s deep experience in artificial intelligence, banking and internet technologies have and continue to shape Katabat’s product development and evolution. Prior to Katabat, Ye worked for Bridgeforce and Ensuredmail, Inc.

Ye is Katabat’s CTO and co-founded the company in 2006. He is an avid technologist and continues to enjoy creating technology solutions to solve business problems. Ye’s deep experience in artificial intelligence, banking and internet technologies have and continue to shape Katabat’s product development and evolution. Prior to Katabat, Ye worked for Bridgeforce and Ensuredmail, Inc.

=

Ye cofounded Katabat in 2006 and continues to enjoy creating technology solutions to solve business problems. Ye’s deep experience in artificial intelligence, banking and internet technologies have and continue to shape Katabat’s product development and evolution. Prior to Katabat, Ye worked for Bridgeforce and Ensuredmail, Inc. Ye received a BS and Master’s degree in Electrical and Electronics Engineering from Sichuan University. He also has his Master’s and Ph.D. in Computer Science from the University of Delaware. Ye is an avid technologist and has published multiple conference and journal articles in the fields of computer vision, pattern recognition, and artificial intelligence.

More from Ye Zhang