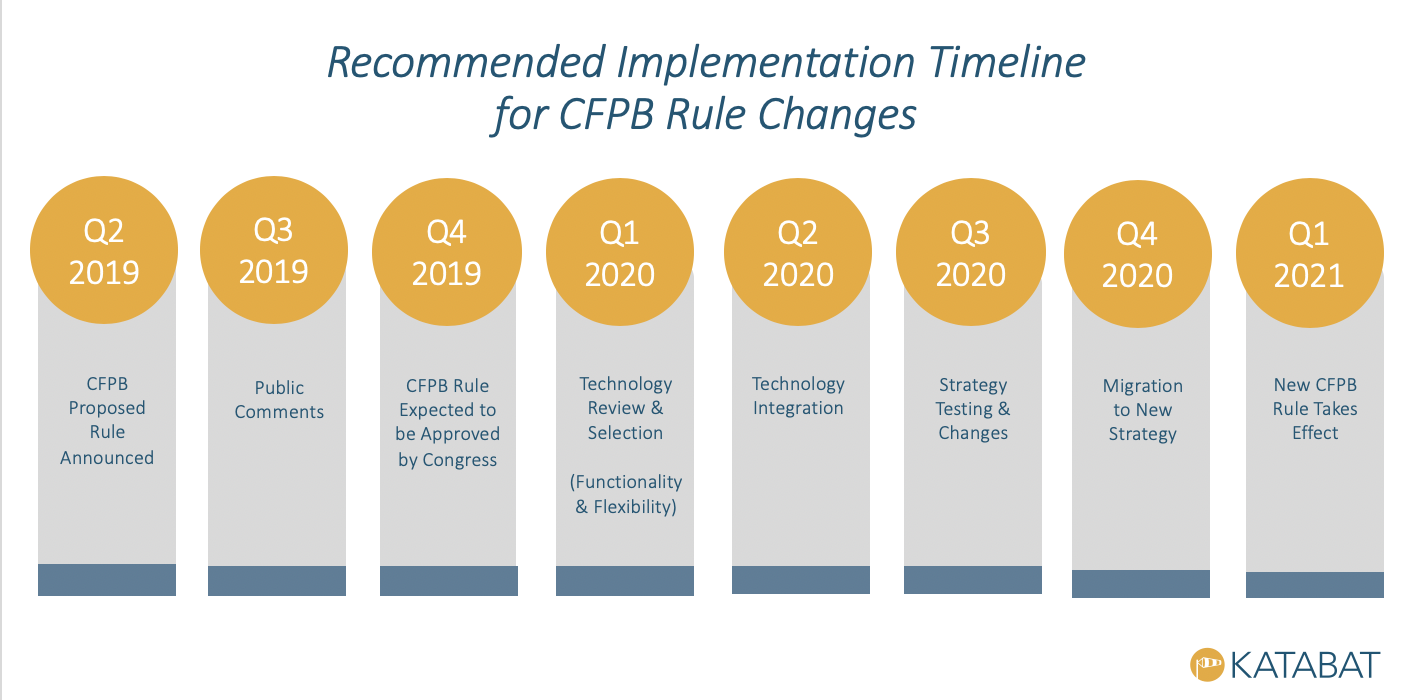

The Consumer Financial Protection Bureau (CFPB) is currently taking public comment on its proposed rule changes that would affect the Fair Debt Collection Practices Act (FDCPA). The comment period closes on August 19, which is right around the corner, but the new rules are not likely to take effect for another 18 to 24 months.

Two years may seem like a long time, but the Debt Collection Agencies (DCAs) that must abide by the new rules have a lot to accomplish before then. It’s not only the rules surrounding debt collection that are changing right now—the methods are changing as well. Consumers expect a high-quality experience on their channel of choice. Collectors need to use the communications methods borrowers expect and prefer, while navigating regulations that were written before mobile technology became popular.

When you add to this scenario a probable recession in the not-so-distant future, two years to prepare hardly seems long enough. What’s critical for lenders is to find technology solutions that are easily configurable, provide an omnichannel customer experience management approach, and can be deployed quickly. In addition, they need to develop a timeline for reviewing vendors, implementing a solution, strategy testing, and full adoption.

Uncertainty Demands Flexibility

The one constant for lenders right now is uncertainty. When will the new CFPB regulations go into effect? When will the predicted recession arrive? How will clients choose to communicate given all of the choices they now have? Will their preferences change if they fall upon hard times?

All of this uncertainty means that the vendors or solutions DCAs choose to work with need to be flexible. What if the regulations change again or get interpreted in a way nobody predicted? If lenders choose easily configurable customer experience management (CXM) technology, they’ll be able to adapt and evolve in a changing environment.

Today’s CXM technology can even go beyond being flexible and configurable—it can see into the future. No, not through a crystal ball, but through machine learning. Machine learning-powered CXM platforms can learn from each customer interaction, see patterns and possibilities that people can’t, and optimize strategies. This leads to improved and increased contact rates, lowered operating costs and compliance risks, and more efficient customer service.

Best-In-Class for Today’s Needs

Once lenders know which providers supply the capabilities, functionality, and flexibility that they need, they have to figure out which ones can get them up and running quickly. If it’s going to take them six months to implement a new CXM system, they’re behind before they’ve even started.

DCAs need to consider how easily a new solution can be deployed. Looking for add-on solutions that will work in tandem with their existing technology stack is key. Think plug-and-play, not rip-and-replace. By using such add-on technology, debt collectors can add the functionality they need quickly and efficiently.

Debt collectors need to realize that they need to look beyond their current providers. Companies that are best-in-class in traditional collections excel in agent work, letter-based communications, and dialer/telephony technology. The best-in-class providers of digital engagement/collections, which is what lenders need now, are different. Most of them were developed as digital-first companies that built functionality specifically to support multichannel communications and transactions. Ideally, DCAs can find digital-first providers that have experience and expertise in collections.

Asking the right questions of potential providers is important in determining whether they can get their clients up and running quickly. What will the deployment timeline look like? Will the solution disrupt the current technology stack, or will it work alongside it? Can more features be added later if it’s decided they are needed? Questions like these will help DCAs ensure they end up with the right solution in a short amount of time.

All Channels, All the Time

Even though the CFPB is just now addressing multiple communication channels, debt lenders who are going to survive need to stay ahead of the curve. Consumers are used to being able to communicate when and how they want. They expect these same choices when paying back debt.

Not only do consumers want to communicate across digital channels, but a recent McKinsey study found that they have higher payment rates when using such channels. Debt collectors need to get consent from clients now. They may consider automated workflow solutions that can help streamline the challenge of consent across multiple channels.

It may seem like CFPB changes, increasing communication channels, and a looming recession are the recipe for a perfect storm for DCAs and other debt lenders. That might actually be a beneficial way to think about it. What do you do when a storm is coming? Prepare. Lenders shouldn’t wait until it’s raining to get everything in order. If they prepare themselves now and follow an aggressive timeline, they’ll be able to ride out the storm with no problem.

Are you looking for more information on making decisions amid changing regulations? Download the CFPB Rule Changes whitepaper here. As always, feel free to reach out at eschuerman@katabat.com.

About Elizabeth Schuerman

Katabat’s Elizabeth Schuerman spent the better part of a decade in first- and third-party collections early in her career, focusing on streamlining medical debt collections processes amidst the nuances of health insurance. After spending five years solving the financial and risk data needs for some of the world’s largest financial institutions, she brings a unique industry perspective to Katabat’s clients as Regional Sales Manager for North America.

Katabat’s Elizabeth Schuerman spent the better part of a decade in first- and third-party collections early in her career, focusing on streamlining medical debt collections processes amidst the nuances of health insurance. After spending five years solving the financial and risk data needs for some of the world’s largest financial institutions, she brings a unique industry perspective to Katabat’s clients as Regional Sales Manager for North America.

=

Katabat is the leading provider of debt collections software to banks, agencies, and alternative lenders. Founded in 2006 and led by a diverse team of lending executives and leading software engineers, Katabat pioneered digital collections and has led the industry ever since. It is our mission to provide the best credit collections software in the market and solve debt resolution from the perspectives of both lenders and borrowers.

More from Katabat