These days, artificial intelligence (AI) is such a buzzword that it is hard to promote an AI solution without sounding like you are selling snake oil. A lot of people have read or heard about AI, and very likely formed their own opinions about what AI is and what AI can and will do based on media coverage. But when it comes to the financial services domain, there are no self-driving cars or killer robots! Therefore, it may be less obvious how banks and fintech companies can take advantage of AI technology.

Predictive Analytics…and Beyond

I want to start by saying that banks, at least sophisticated ones, have been taking advantage of “predictive analytics” for many years. Predictive analytics are sort of like weather forecasting. The business goal of predictive analytics is to predict the future performance of financial products offered at an individual customer level based on historical data. In other words, banks have been using data analytics (statistics tools) to improve their efficiency, control their risk, and promote their products for years.

In the era of AI, these fundamental goals have not changed: now we just have better tools—like AI—to perform the predictive analysis more efficiently and effectively. There are also other use cases of AI in the financial services domain that have nothing to do with predictive analytics. For example, banks can use computers to understand text documents such as contracts and dialogue records to improve their compliance status. However, in this blog post, I will only focus on AI used for predictive analytics in the financial services industry.

Breaking Down Machine Learning

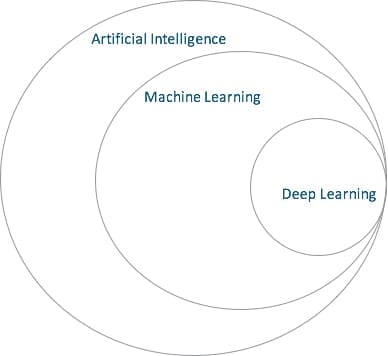

Now what exactly are the AI tools we are talking about? Well, to explain that clearly, I will use another buzzword that is almost as hot as AI itself: machine learning (ML). AI is a broad concept—in fact, you can call anything that mimics some significant part of human intelligence “AI.” As its name suggests, AI is a wide-ranging discipline with an intention to mimic or recreate human intelligence. On the other hand, machine learning is a specific group of methods (one of the methods is deep learning, another buzzword) used to mimic or recreate human intelligence. Roughly, you can draw a picture like this:

This new era of AI features a lot of machine learning tools that previously were not widely used for predictive analytics in the financial services domain. Of course, a lot of these tools are not really “new” tools: they simply were not usable 10 years ago. At the time, the lack of strong hardware like today’s GPUs meant that we did not have enough computational power. There was also not enough data to train the machine learning models. For example, convolutional neural networks (CNN) were invented in the 1980s, but they have begun to shine only recently due to significant progress in data gathering and computational power. In financial services, computational advances mean that machine learning tools such as deep learning (neural networks), XGBoost, and LightGBM now show significant promise in predictive analytics.

One thing worth mentioning is that traditional statistical tools and machine learning tools have a lot of intersections. For example, linear and logistic regressions are statistical tools as well as machine learning tools. In fact, academic debates have been going on forever regarding whether “machine learning is just glorified statistics,” and there are plenty of materials talking about the similarities and differences between statistics and machine learning. However, as a pragmatic AI practitioner at Katabat, I do not believe it is productive to spend more time on this debate—who cares what it’s called, as long as the tools bring the desired results?

Machine Learning on the Ground

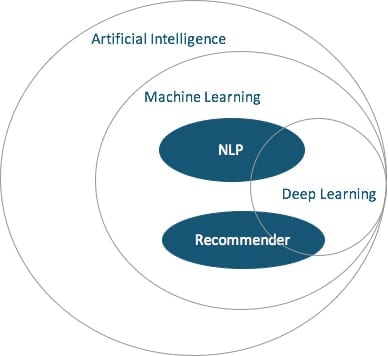

At Katabat, we focus on using two types of machine learning tools to help financial institutions. Specifically, we focus on natural language processing (NLP) and recommender systems. Roughly, you can draw a picture like this:

We use a wide range of tools, including but not limited to TFIDF, deep learning, XGBoost, LightGBM, SVM, and good old regression to solve NLP and recommender system problems arising in financial services. Here are two sample use cases:

1. Tailor specific email subject and content for an individual customer

The problem: We have experienced content writers develop five different content and subject templates with the same intention: for example, to offer the same interest reduction program. We want to increase the response rate for this email promotion.

The traditional solution: Launch A/B tests, and empirically determine which subject/content template is the best based on group behavior from customers. Then discard the other templates.

The AI solution: Use machine learning tools to score every subject and content template at the individual customer level. The higher the score, the higher the chance of getting a response from this specific customer.

The advantage of an AI solution: Traditional A/B testing is time consuming. And it normally tells you which subject/content template is the champion for a cohort of customers, not an individual customer. As a result, it is not very precise. Our experience is that machine learning models, after training, can provide much more personalized results at the individual customer level.

2. Pick the best treatment plan for a delinquent customer

The problem: We have experienced strategists develop five different treatment strategies to communicate with delinquent customers. We want to increase the right party contact (RPC) rate and/or final dollar collected from delinquent customers.

The traditional solution: If the financial institution has a strategy engine and a workflow engine, strategists will write a segmentation strategy based on their own experience and assign treatment strategies to customers. If the financial institution does not have a sophisticated strategy engine, they typically write some ad hoc strategy implementations which may be less efficient.

The AI solution: Katabat already has advanced strategy and workflow engines, so we use machine learning tools to score every human-written strategy and find the most suitable strategy at the individual customer level.

The advantage of an AI solution: The machine learning system adjusts the scoring model promptly and automatically, which results in the customer always being treated with the best strategy without human intervention. This results in a significant efficiency gain. Here, the efficiency gain does not only come from the reduction of labor, but also from the ability to adjust the system quickly in a way human beings rarely can, thus providing a better experience for the customer.

There are other specific use cases we are working on at Katabat. These two examples illustrate one part of the range of what can be done using AI in the financial services industry. We are currently testing these systems, gathering data, and look forward to sharing further updates! Feel free to contact me in the meantime at yzhang@katabat.com to discuss AI’s amazing potential.

=

Ye cofounded Katabat in 2006 and continues to enjoy creating technology solutions to solve business problems. Ye’s deep experience in artificial intelligence, banking and internet technologies have and continue to shape Katabat’s product development and evolution. Prior to Katabat, Ye worked for Bridgeforce and Ensuredmail, Inc. Ye received a BS and Master’s degree in Electrical and Electronics Engineering from Sichuan University. He also has his Master’s and Ph.D. in Computer Science from the University of Delaware. Ye is an avid technologist and has published multiple conference and journal articles in the fields of computer vision, pattern recognition, and artificial intelligence.

More from Ye Zhang